Since the unplanned outages in 2018 at New Zealand’s largest gas field, Pohokura, gas prices on the emsTradepoint market have doubled. With a series of monthly forward trades going through the market over the last two weeks of November, and growing uncertainties around future supply, it seems this marked increase might be here to stay.

What is the current state of gas supply?

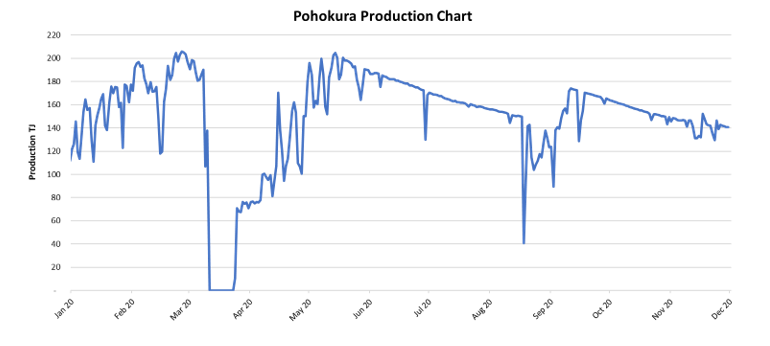

Pohokura is NZ’s largest gas field and its production has been declining since May. Now OMV, its operator, has updated forecast availability through 2021 at a 25% reduction to previously expected levels.

The decline follows planned maintenance (Mar-May) and despite additional intervention (including a compressor installation in September), production has not returned to previously expected levels.

OMV has exceeded disclosure requirements in updating the 2021 forecasts, and shows commitment to transparency and a recognition of the significance this poses to gas users. Further details on the forecast from OMV can be found on the GIC Industry Notification page.

The graph below shows Pohokura’s production profile during 2021.

Downstream struggles to secure gas: Feedback that we have received suggests downstream parties are struggling to secure contracted gas. This is a similar issue to what we saw following Pohokura outages at the end of 2018. There seems to be a reluctance for upstream parties to submit on RFPs, as well as contract prices being offered significantly above those set prior to 2018.

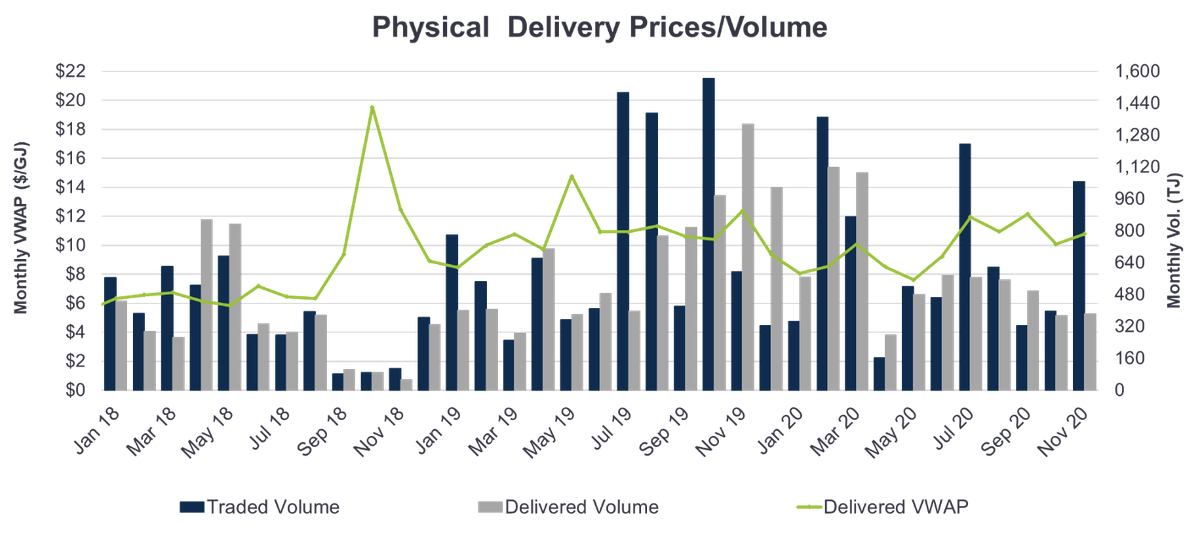

Volume on the market: The graph above shows gas volume traded and delivered through our exchange. High traded volume in a month generally indicates high levels of forward trading. The second half of 2019 saw good monthly volume traded through the market. This reflected uncertainty caused by the 2018 outages, and the struggle for downstream parties to secure contracted gas. It seems history could be repeating itself coming in to the the back end of 2020, with a number of monthly forward trades going through. Brokered time swap trades also contributed to some of this volume.

What is happening with gas prices on emsTradepoint?

Prices on the market: Prior to the 2018 Pohokura outages, monthly delivered volume weighted average prices (VWAP) on the gas market averaged $5.70/GJ. The monthly VWAP peaked to almost $20/GJ during the height of the outages. The monthly VWAP since the Pohokura outages have increased to an average of $10.28.

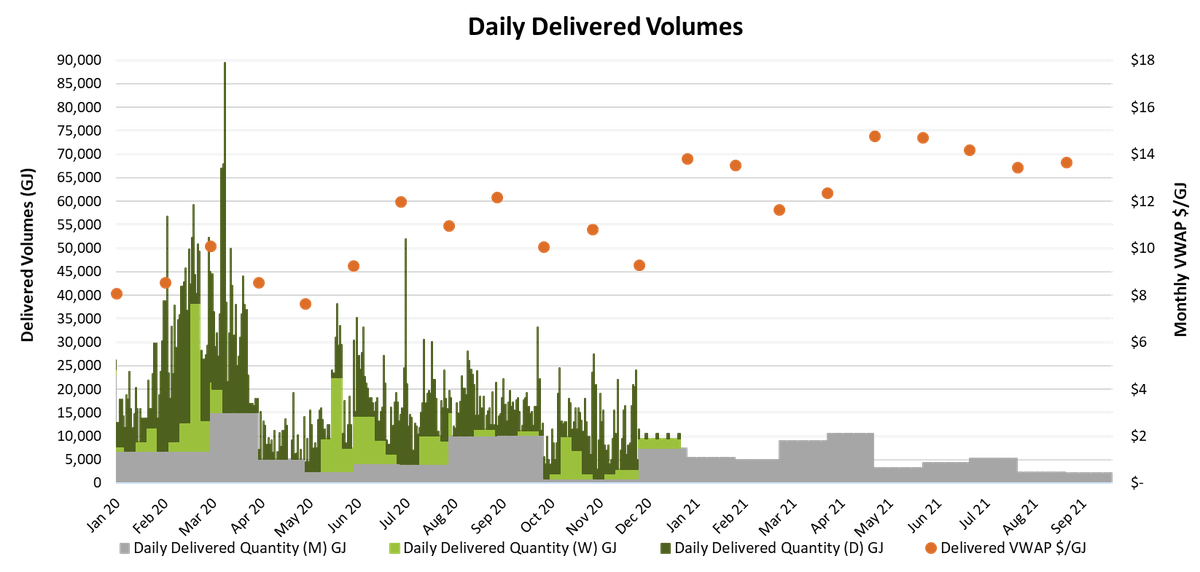

Prices on emsTradepoint are a reflection of the tight supply. The market currently has forward trades out to the end of the gas year 20/21. Although prices are often peaky on the day, the monthly VWAP on the market is showing an upward trend. In recent weeks there has been an increased volume of monthly forward trades. This reaffirms the high pricing. The monthly VWAP for 2021 ranges from $11.63/GJ to $14.75/GJ.

Carbon Prices: The emsTradepoint gas price is inclusive of a carbon component. This is calculated at the prevailing market price for carbon converted from $/NZU basis to $/GJ. The carbon component of the gas price is increasing as the carbon price continues its upward trajectory.

The table below shows the average price of carbon each year converted to $/GJ. This shows the effect of the Government’s announcement of the Fixed Price Option (FPO) increase to $35 for 2020 emissions. The increase in the ratios of emitters’ obligations to surrender units between 2017 and 2019 has contributed to the upward trend in price.

Carbon prices have continued to increase above the $35 threshold. This is a sign of the expected impact the auction process will have on carbon prices. The auctions will replace the FPO scheme.

What do we expect in the market going forward?

The trend we’re currently seeing is tight supply and high prices. The recent announcements around the declining rates at Pohokura and Maui fields have only emphasised this, creating more market uncertainty.

Increasing carbon prices are also putting pressures on downstream gas users.

December is generally a slow month for the emsTradepoint gas market, however given the procurement issues there may be appetite to secure gas for 2021, assuming there is willingness for suppliers to sell.

We publish emsTradepoint historic price and volume data on our website. To view the live market, or for any other data queries or information please get in touch with one of the team.

-

Download a copy of the article here. pdf 381.8 KB