On 20 July 2020 Firstgas issued a Market-Based Tender to procure 411 TJ of operational gas for the Gas Year 2020/21. Firstgas’ requirements ensured that the resulting trades were able to be transacted through emsTradepoint, simplifying the process and shortening the potential timeframe. With emsTradepoint providing a central counterparty clearing role, Firstgas was able to procure gas from multiple parties while keeping transaction costs low. The tender was designed and facilitated by Aotearoa Energy.

We published details of the tender in an article on 24 July.

The result was positive for Firstgas, filling 100% of its Fuel Gas needs for the upcoming gas year.

How were the tender results compiled?

- All compliant offers submitted to the tender process were due on 7 August. All offers had any identifying information removed before being passed on to Firstgas.

- All offers were in the form of monthly contracts, compliant with the emsTradepoint Monthly Product within the supply period.

- The required daily quantity was filled starting with the lowest price offer for that month, followed by the next lowest price, until the daily quantity was fully satisfied. Any offer was able to be partially accepted.

- All accepted offers were then executed as off-market-trades between Firstgas and the successful parties on emsTradepoint’s platform in accordance with emsTradepoint’s Market Rules.

What were the results?

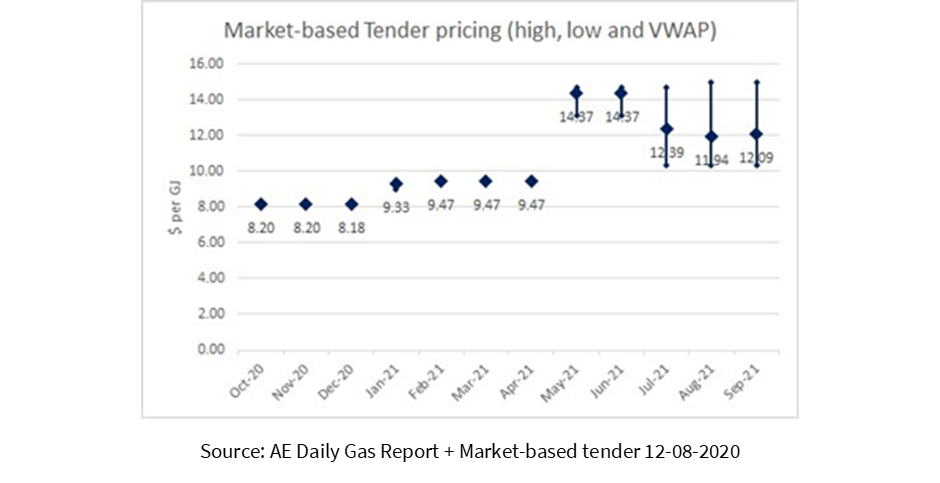

A total of 22 trades from multiple parties were accepted by Firstgas, fulfilling 100% of the required daily quantity for the 12-month supply period. Prices of accepted offers ranged from $8.20/GJ to $15.00/GJ. As with all prices on emsTradepoint these include the cost of carbon. Carbon price risk is becoming an increasing concern for buyers with the recent increase to the ETS Fixed Price Option to $35 and the signaled mid-term removal of any price cap.

Asked about its experience running a Market-Based Tender through our platform, Firstgas said:

“Firstgas is very pleased with the outcome of the market-based tender for our fuel gas needs. The format allowed us to contract for our needs from multiple sources, which provided us with a diversity of supply sources and a competitive price. We now have price certainty for the coming gas year, both on the fuel gas itself and on the associated carbon emission units.”

Will we see more Market-Based Tenders?

The success of this Market-Based Tender demonstrates how traditional procurement methods (such as RFPs) can transition to exchange-based procurement by using standard product definitions, clear rules and a transparent fee structure.

This procurement method has many benefits:

- access to the full depth of suppliers active in the market,

- a range of offers that provide a diversified portfolio, enhancing security of supply for the buyer, and

- lower administrative costs by using emsTradepoint as the central counterparty, simplifying the procurement process for all parties.

How to find out more

If you want to know more about Market-Based Tenders, or other trading on our exchange, please get in touch with us. We are available from 9am to 5:30pm, 7 days a week.

-

Market-Based Tender - Results Article pdf 123.5 KB